Vietnam 2026: Economic Outlook

- limanchun23

- Jan 19

- 5 min read

Updated: Jan 27

A Structural Growth Story - With Execution at Its Core

Over the past two years, as global capital markets adjusted to higher interest rates, geopolitical fragmentation, and deepening China-West decoupling, one Southeast Asian economy has quietly confirmed its place as a structural, execution-ready growth market: Vietnam.

While many emerging markets relied on stimulus or cyclical rebounds, Vietnam continued to attract manufacturing investment, expand industrial output, and maintain macroeconomic stability. The result is a growth profile that looks increasingly durable rather than temporary - anchored by supply chains, supported by domestic demand, and reinforced by long-term demographic and policy tailwinds.

As Vietnam approaches 2025-2026, the message to investors and operators is clear:

Vietnam offers real, scalable upside - but rewards only those prepared to execute on the ground.

From Reform Economy to Global Supply-Chain Anchor

Vietnam’s rise is not cyclical. It is the outcome of decades of structural reform that began with Đổi Mới, the country’s economic renovation program that opened Vietnam to global trade and private enterprise.

That long-term trajectory has been tested - and strengthened - by three major global shocks:

The COVID-19 pandemic, during which Vietnam stood out as the only Southeast Asian economy to record real GDP growth in 2020, thanks to rapid crisis management while peers endured prolonged contractions.

The US-China tariff war, which accelerated the relocation of global manufacturing into Vietnam as firms sought neutral, scalable production alternatives.

Ongoing geopolitical decoupling, which continues to push multinationals to diversify supply chains away from concentrated risk.

Each shock reinforced Vietnam’s role as a politically stable, WTO-aligned manufacturing base rather than derailing it.

Investor takeaway: Vietnam’s momentum is crisis-tested and structurally reinforced - not stimulus-driven.

Growth With Stability: A Rare Emerging-Market Combination

Vietnam’s recent performance highlights a combination that remains rare among high-growth economies: expansion without overheating.

Industrial production is up 9.3% year-to-date, with growth recorded across all 34 provinces - underscoring that this is not a single-city or single-sector story.

Retail sales rose 9.1% year-on-year, translating into 6.8% real growth.

Household incomes remain resilient, with 96.4% reported as stable or rising.

Inflation has stayed contained at approximately 3.3% YTD, preserving purchasing power.

Hot-take: Vietnam is achieving growth without sacrificing price stability - a combination that continues to attract long-term capital.

Manufacturing: The Core Growth Engine

Manufacturing is not a supporting pillar of Vietnam’s economy. It is the primary driver.

Manufacturing output grew 10.6% year-on-year, accounting for the majority of industrial expansion. Vietnam has become a key production base for global manufacturers including Samsung, Wistron, LEGO, Škoda, Jabil, Luxshare ICT, Hyundai, LG Electronics, Apple, Intel, and ASML.

The structure of trade and investment underscores how deeply manufacturing is embedded:

76% of exports are generated by FDI enterprises

Manufactured goods account for ~89% of total exports

94% of imports are capital goods - machinery, automation, and industrial equipment

Industrial employment increased 3.7% year-on-year

Cumulatively, manufacturing and processing have attracted USD 320.7 billion in registered FDI - 61.3% of all foreign capital - far exceeding real estate and power generation.

Implication: Vietnam is no longer just a low-cost alternative. It is one of Asia’s most execution-ready China+1 platforms.

Trade, Geopolitics, and Strategic Balance

Vietnam’s trade profile reflects its unique geopolitical positioning.

Total trade reached approximately USD 840 billion, up 17.2% year-on-year, with a USD 20.5 billion surplus. The United States remains Vietnam’s largest export destination, while China is its largest import source - a dual dependency that underscores Vietnam’s role as a connector between major economic blocs.

Foreign-invested enterprises continue to run significant trade surpluses, offsetting domestic deficits and reinforcing Vietnam’s appeal as a production base rather than a speculative market.

Capital Still Flows - Even in a Volatile World

Despite global uncertainty, Vietnam continues to absorb capital at scale:

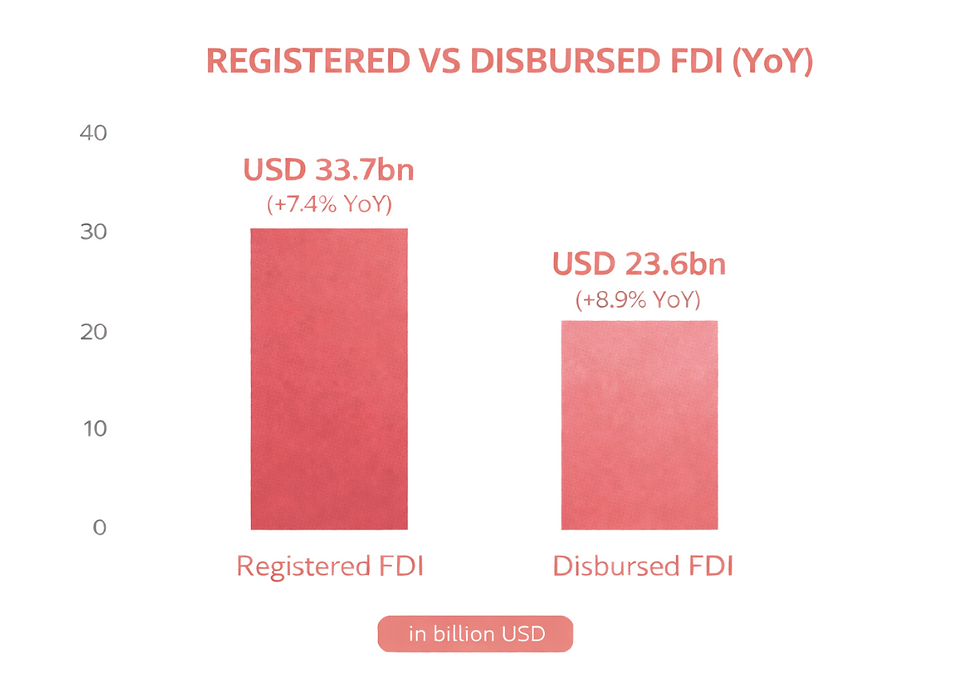

Registered FDI reached USD 33.7 billion (+7.4% YoY)

Disbursed FDI rose to USD 23.6 billion (+8.9% YoY)

Public investment surged 26.8% year-on-year, driving infrastructure, logistics, and energy development

Outbound Vietnamese FDI jumped approximately 84%, signaling the emergence of regional Vietnamese champions

Conclusion: Vietnam is no longer merely capital-hungry - it is becoming capital-circulating.

Entry Is Easy. Survival Is Not.

Vietnam’s business formation data offers a reality check behind the headlines.

In eleven months, 275,000+ firms entered or resumed operations - yet 205,000 exited during the same period. At the same time, registered capital doubled, indicating serious commitments rather than shell entities.

Investor takeaway: Entry is easy. Survival and scale demand localisation, compliance discipline, and on-the-ground execution.

Infrastructure, Logistics, and Mobility Catch Up

Vietnam’s physical capacity is increasingly aligned with its economic ambition.

Freight volumes rose 14-15% year-on-year, while passenger movement surged 22%, reflecting urbanisation and workforce mobility. Three ports - Hải Phòng, Ho Chi Minh City, and Cái Mép - now rank among the world’s top 50 busiest container ports.

Vietnam’s liner shipping connectivity has steadily improved since 2020, reinforcing its role as a logistics bridge between the Indian and Pacific Oceans along its 3,260-kilometre coastline.

Tourism, Talent, and Soft Power

Tourism and mobility continue to support domestic demand and global engagement.

Vietnam welcomed 19.1 million international visitors, up 21%, while visa easing and global event hosting have reduced friction for founders, professionals, and investors testing the market.

Rising cultural visibility has strengthened Vietnam’s appeal to IP-driven, lifestyle, and media brands - an increasingly important dimension of long-term competitiveness.

ESG Risks — And Opportunities

Climate and environmental risks are real - and increasingly priced.

Flooding and climate damage are estimated to exceed VND 99 trillion, while environmental regulation is tightening across wastewater, emissions, and industrial compliance. Yet these pressures are creating first-mover advantages for clean technology, industrial services, and resilience solutions.

Conclusion: ESG in Vietnam is no longer optional. It is a growing source of structural demand.

A Decade-Long Consumption Upgrade

Vietnam is entering a consumption upgrade cycle that could define the next decade.

The middle class is projected to double from 13% in 2023 to 26% by 2026, adding roughly 25 million consumers. The median age remains just 33, with rising digital adoption and education levels driving demand for education, healthcare, housing, lifestyle, and premium goods - particularly in tier-2 and tier-3 cities.

Competitive - Without Being Fragile

Vietnam remains cost-competitive across labour and taxation while offering scale and regulatory depth:

Labour costs remain well below major regional peers

Standard corporate income tax sits at 20%, lower than most neighbouring economies

Conclusion: Vietnam balances competitiveness with institutional maturity - a rare combination.

Open, Integrated, and Strategically Aligned

Vietnam maintains 17-18 free-trade agreements covering roughly 60 economies, including ASEAN, CPTPP, EVFTA, and RCEP. Double-tax agreements span 80+ countries, while diplomatic relations extend to 194 nations, including strategic partnerships with all major global powers.

This architecture reinforces Vietnam’s role as a neutral, rules-based platform in an increasingly fragmented world.

What This Means for Entrants in 2026

Vietnam today is a high-growth, execution-intensive market.

The upside favours manufacturing, industrial services, infrastructure, consumer brands with localisation, and ESG-driven solutions. The principal risk is not demand - it is poor execution.

Poor local setup, compliance gaps, and weak coordination destroy value.

Why Entra

Entra converts Vietnam’s macro opportunity into on-the-ground execution - from entry strategy and entity setup to compliance, localisation, and day-to-day operations. We do not advise from a distance. We operate locally and close the gaps where most market entries fail.

We work with leading consumer brands, top-tier universities, fast-growing fintech platforms, education groups, and family offices, supporting them at critical moments of Vietnam market entry and expansion. Our role typically spans market assessment, localisation strategy, partner coordination, and on-the-ground execution.

If Vietnam is on your 2026 roadmap, don’t guess. Execute it properly from day one. Enquire at vincent@helloentra.com.

Important Notes

This material is provided for general informational purposes only and does not constitute legal, tax, regulatory, financial, or professional advice.

© 2025 Entra Consulting Company Limited. All rights reserved.

.png)